In the dynamic world of Australian business, staying ahead requires innovative solutions that streamline operations and enhance efficiency.

MYOB, a leading business software company, is a trusted ally for small—to medium-sized enterprises looking to unlock their full potential.

Whether you’re an entrepreneur just starting or a seasoned business professional, MYOB Australia offers tools designed to simplify processes and drive growth.

With MYOB online, businesses can access essential financial data anytime, anywhere, empowering them to make informed decisions confidently.

Join us as we delve into how MYOB can transform your business landscape and help you achieve success in today’s competitive market.

Why Choose MYOB Australia?

MYOB Australia has established itself as a cornerstone of business management software in the country.

Let’s explore why it’s the go-to choice for many Australian businesses.

Benefits of MYOB for Business Growth

MYOB Australia offers a comprehensive suite of tools designed to fuel business growth. Streamlining financial processes allows businesses to focus on core operations and strategic planning.

One of the primary benefits is time savings. MYOB automates many repetitive tasks, freeing up valuable hours that can be redirected towards business development.

Improved financial visibility is another crucial advantage. With real-time reporting and analytics, business owners can make informed decisions quickly and adapt to market changes with agility.

Lastly, MYOB’s scalability ensures that as your business grows, the software grows with you, eliminating the need for disruptive system changes later on.

Understanding MYOB Online Features

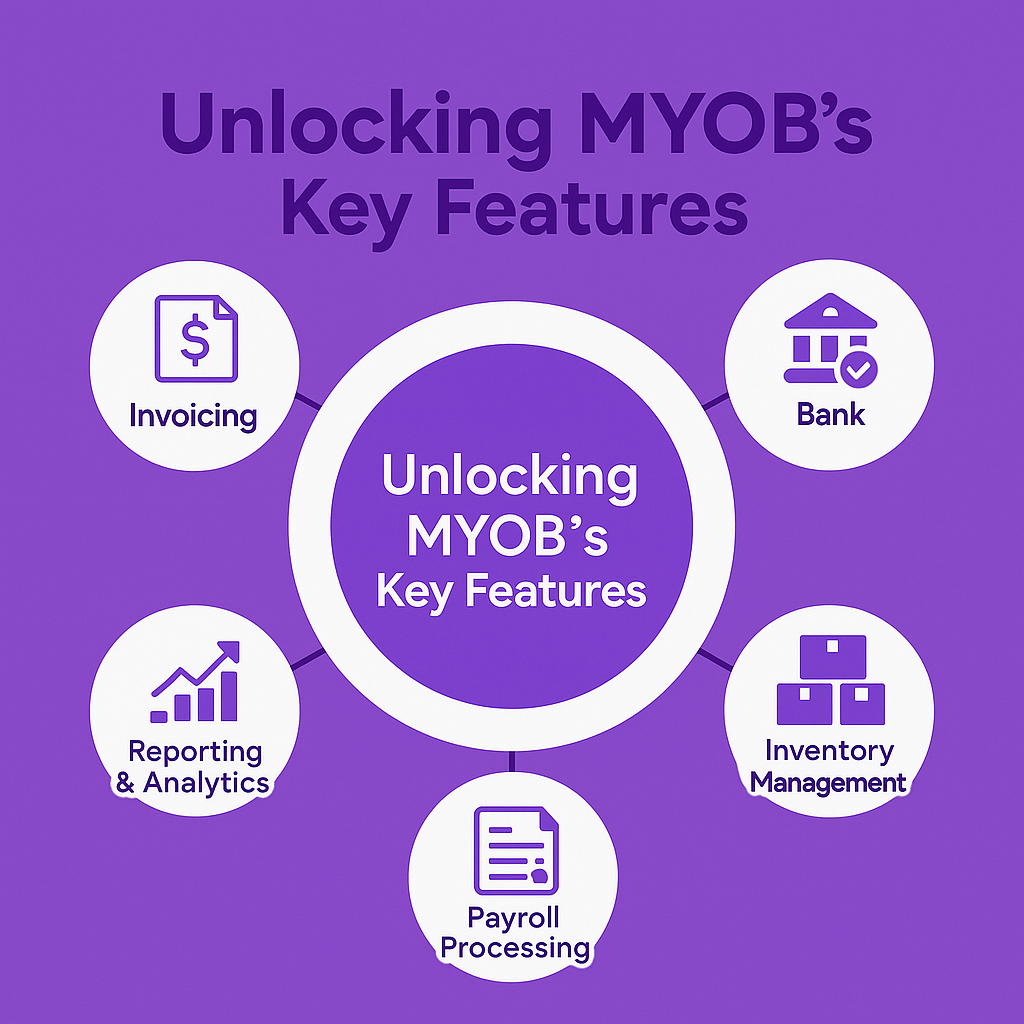

MYOB online brings the power of cloud-based accounting to Australian businesses. Its features are designed to simplify complex financial tasks and provide accessibility from anywhere.

Key features include:

-

Real-time bank feeds

-

Automated invoice creation and sending

-

Payroll management

-

Inventory tracking

-

GST calculation and reporting

These online features ensure businesses can manage their finances efficiently, from the office or on the go. The cloud-based nature of MYOB online also means automatic updates and backups, reducing IT overhead.

Moreover, the platform’s user-friendly interface makes it accessible to users with varying levels of accounting expertise, promoting widespread adoption within organizations.

MYOB’s Competitive Edge

MYOB stands out in the crowded field of business software due to its deep understanding of the Australian market. This local expertise translates into features tailored specifically for Australian businesses.

MYOB’s competitive edge lies in its:

-

Compliance with Australian tax laws and regulations

-

Integration with local banks and financial institutions

-

Robust customer support based in Australia

Furthermore, MYOB’s commitment to innovation ensures that it stays ahead of the curve, regularly introducing new features that address emerging business needs.

The software’s ability to cater to businesses of all sizes, from sole traders to large enterprises, gives it a versatility that few competitors can match.

Setting Up MYOB for Success

Proper setup is crucial for getting the most out of MYOB. This section will guide you through the essential steps to ensure a smooth start with the software.

Essential Steps for Beginners

Getting started with MYOB can seem daunting, but following a structured approach can make the process smooth and efficient.

-

Choose the right MYOB product for your business size and needs. MYOB offers various solutions, from basic accounting to comprehensive business management systems.

-

Set up your company file. This involves entering your business details, chart of accounts, and opening balances. Take time to ensure this information is accurate, as it forms the foundation of your financial records.

-

Configure your preferences, including tax settings, financial year dates, and reporting options. These settings will ensure MYOB aligns with your specific business requirements.

Remember, MYOB offers extensive resources and support for new users. Don’t hesitate to leverage these tools during the setup process.

Customizing MYOB for Your Business

MYOB’s flexibility allows extensive customization to suit your business’s unique needs. This tailoring process is crucial for maximizing the software’s effectiveness.

Start by reviewing your chart of accounts. While MYOB provides industry-specific templates, you may need to add, remove, or modify accounts to accurately reflect your business structure.

Next, customize your invoices and forms. Adding your logo and adjusting layouts can enhance your professional image and brand consistency.

Consider setting up job tracking if you manage projects or need to track profitability by client or service. This feature can provide valuable insights into your business performance.

Lastly, configure user access levels to ensure data security and appropriate task delegation within your team.

Troubleshooting Common MYOB Issues

Even with careful setup, you may encounter issues while using MYOB. Understanding common problems and their solutions can save time and frustration.

One frequent issue is bank feed discrepancies. Check for duplicates or missed entries if your bank transactions don’t match MYOB records. Regularly reconciling accounts can prevent this problem from escalating.

Data file corruption can occur, especially with older versions of MYOB. Regular backups are crucial. If you suspect file corruption, use MYOB’s built-in file verification and repair tools.

Sometimes, users encounter report generation errors. This often stems from incorrect account classifications or date range settings. Double-check these parameters when troubleshooting report issues.

MYOB’s support team is always available to help with more complex problems. Don’t hesitate to reach out if you’re stuck.

Maximizing MYOB Online

MYOB online offers powerful features that can transform your business operations. Let’s explore how to leverage these tools to their full potential.

Integrating MYOB with Other Tools

MYOB’s ability to integrate with other business tools can significantly enhance its functionality and streamline your overall business processes.

Popular integrations include:

-

E-commerce platforms (e.g., Shopify, WooCommerce)

-

Customer Relationship Management (CRM) systems

-

Point of Sale (POS) systems

-

Time tracking tools

These integrations allow for seamless data flow between systems, reducing manual data entry and the potential for errors.

Consider exploring MYOB’s app marketplace to find integrations that align with your business needs. Many of these can automate tasks like creating invoices from sales data or tracking expenses from receipt images.

Remember to regularly review and update your integrations to ensure they continue to meet your evolving business requirements.

Streamlining Financial Processes

MYOB online excels at simplifying complex financial tasks, allowing businesses to manage their finances more efficiently.

One key feature is automated bank feeds connecting MYOB to your business bank account automatica, whichlly imports andimportrizescategorizens, saving hours of manual data entry.

Recurring transactions can be set up for regular expenses or income, further reducing manual input. This feature is particularly useful for subscription-based businesses or those with consistent monthly payments.

MYOB’s invoice automation capabilities can significantly speed up your billing process. You can set up recurring invoices, send reminders for overdue payments, and even accept online payments directly through invoices.

Leveraging these features can free up valuable time, allowing you to focus on strategic business activities rather than routine financial tasks.

Leveraging MYOB for Data Insights

MYOB’s reporting capabilities provide valuable insights that inform business decisions and strategy.

The software offers a range of customizable reports, from basic profit and loss statements to detailed cash flow projections. Regularly reviewing these reports can help identify trends, opportunities, and potential issues before they become problems.

Real-time dashboards in MYOB online provide at-a-glance views of key business metrics. These can be customized to display the most relevant information for your business, whether that’s cash position, top customers, or inventory levels.

Consider using MYOB’s budgeting tools to set financial goals and track progress. By comparing actual results against budgets, you can quickly identify areas that need attention or adjustment.

Remember, the actual value of data lies in how you use it. Regularly schedule time to analyze your MYOB reports and use these insights to drive your business forward.

MYOB Best Practices

Adopting best practices in using MYOB can significantly enhance its effectiveness and value to your business. Let’s explore some key strategies.

Optimizing MYOB for Efficiency

Efficiency is key to getting the most out of MYOB. Implementing best practices can streamline your processes and save valuable time.

Regular data entry is crucial. Set aside time daily or weekly to update your MYOB records. This prevents backlogs and ensures your financial data is always up-to-date.

Utilize shortcuts and hotkeys to navigate MYOB faster. Familiarize yourself with these time-savers to speed up everyday tasks.

Create templates for recurring transactions or frequently used forms. This reduces data entry time and minimizes errors.

Lastly, regularly review and clean up your data. Archive old records, remove duplicate entries, and ensure your chart of accounts remains relevant to your current business structure.

Staying Compliant with MYOB

MYOB is designed to help Australian businesses meet their compliance obligations, but using the software correctly is essential to ensure full compliance.

Keep your MYOB software updated to the latest version. This ensures you have the most recent tax rates and compliance features.

Regularly reconcile your accounts to catch any discrepancies early. This is particularly important for GST reporting and end-of-year tax preparations.

Set up reminders for key compliance dates, such as BAS lodgment deadlines. MYOB can help automate many of these processes, but it’s still important to oversee them.

Remember, while MYOB is a powerful tool for compliance, consulting with a qualified accountant or tax professional for complex compliance matters is always advisable.

Engaging with MYOB Support Services

MYOB offers comprehensive support services to help users get the most out of the software. Knowing how to engage with these services effectively can enhance your MYOB experience.

The MYOB Help Centre is a valuable resource for self-service support. It contains detailed guides, video tutorials, and FAQs covering a wide range of topics.

MYOB’s customer support team is available via phone, email, and live chat for more personalized assistance. Before contacting them, prepare your account details and a clear description of your issue to expedite the process.

Consider joining the MYOB community forums. These platforms allow you to connect with other users, share experiences, and often find solutions to common issues.

Remember MYOB’s training options. Whether through webinars, workshops, or certified courses, ongoing education can help you unlock new efficiencies in your software use.

MYOB’s Role in Future Business

As business landscapes evolve, MYOB continues to adapt and innovate. Let’s explore how MYOB is positioned to support businesses in the future.

Adapting to Market Changes with MYOB

MYOB’s commitment to innovation ensures that businesses can stay agile in the face of market changes.

The software’s cloud-based nature allows for rapid updates and feature rollouts, ensuring users always have access to the latest tools and compliance updates.

AI and machine learning capabilities are integrated into MYOB, offering predictive analytics and automated data entry. These features can help businesses anticipate trends and make data-driven decisions.

MYOB’s focus on mobile accessibility aligns with the growing trend of remote work and on-the-go business management. This flexibility allows businesses to operate efficiently regardless of physical location.

As markets evolve, MYOB’s adaptability ensures businesses have the tools to respond quickly and effectively to new challenges and opportunities.

Future-Proofing Your Business with MYOB

Investing in MYOB is a step towards future-proofing your business. The software’s scalability and continuous updates mean it can grow and evolve with your business.

Data security is a growing concern, and MYOB’s robust security measures, including encryption and multi-factor authentication, help protect your sensitive financial information.

Integration capabilities ensure that MYOB can connect with new technologies as they emerge, maintaining its central role in your business ecosystem.

MYOB’s commitment to compliance means that as regulations change, the software will be updated to help businesses stay compliant with minimal effort.

By leveraging MYOB’s full suite of tools and staying engaged with its evolving features, businesses can thrive in future challenges and opportunities.

Innovations in MYOB for 2024 and Beyond

MYOB continues to push the boundaries of business software, with several exciting innovations on the horizon.

Artificial Intelligence is set to play a more significant role, with MYOB exploring AI-driven financial forecasting and anomaly detection to help businesses make more informed decisions.

Blockchain technology is being investigated for its potential to enhance security and streamline transactions, particularly in areas like supply chain management.

MYOB is also focusing on enhanced customization options, which will allow businesses to tailor the software even more closely to their specific needs and workflows.

Looking further ahead, MYOB is exploring augmented reality interfaces for data visualization and natural language processing to make software interaction more intuitive.

These innovations demonstrate MYOB’s commitment to staying at the forefront of business technology, ensuring Australian businesses have access to cutting-edge tools for years.