Navigating the world of small business accounting can often feel like traversing a complex maze, but understanding and mastering it is crucial for the success of your enterprise.

With the right accounting software, small business owners and entrepreneurs can streamline their financial operations, making the daunting task of bookkeeping more manageable and efficient.

In this post, we’ll delve into the best accounting tools designed specifically for small businesses, exploring how automated bookkeeping and cloud accounting solutions can save you time and reduce errors.

Discover how financial software for small business can transform your accounting practices, empowering you to focus more on growing your business and achieving your entrepreneurial goals.

Join us as we uncover the strategies and resources that will help you optimize your financial management processes and drive your business forward.

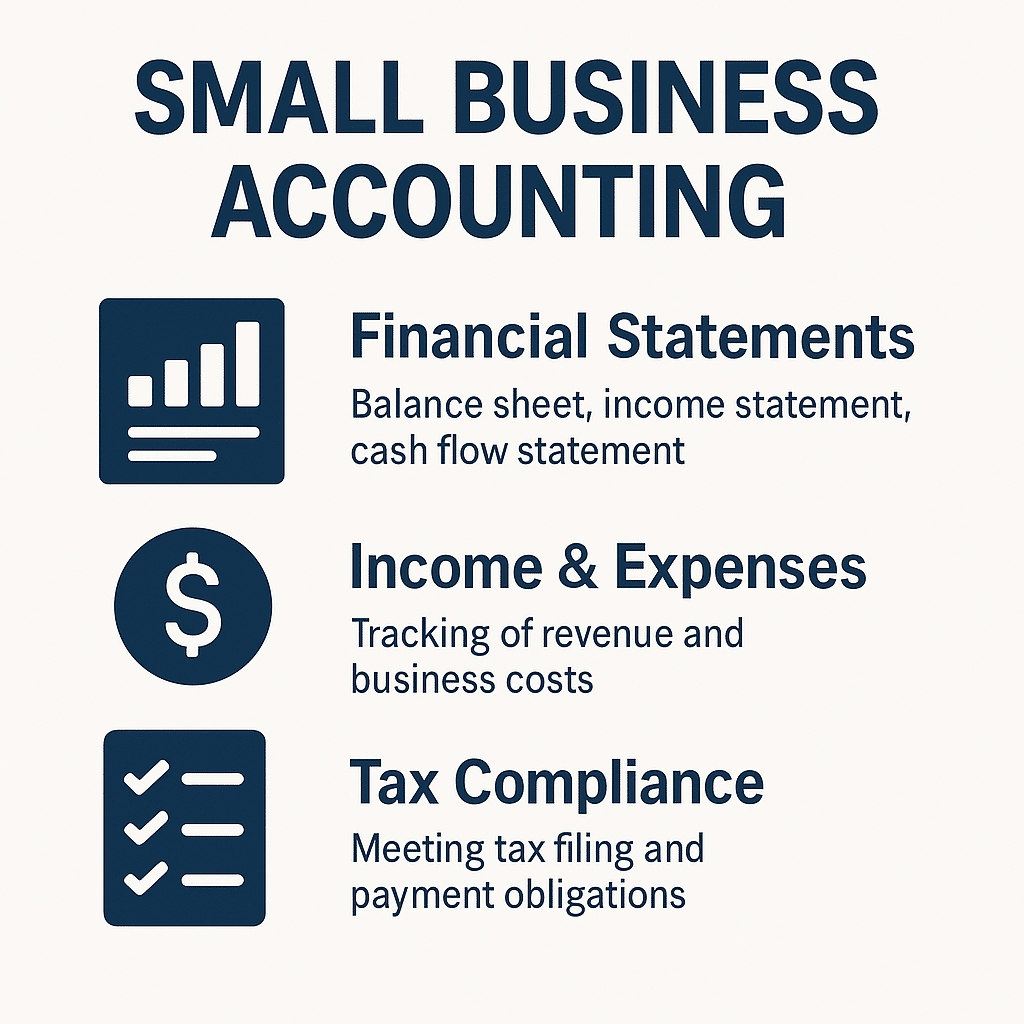

Understanding Small Business Accounting

Small business accounting forms the backbone of financial management for entrepreneurs. Let’s explore the key aspects that make it crucial for your business success.

Importance of Financial Management

Financial management is the cornerstone of any successful small business. It provides a clear picture of your company’s financial health, enabling informed decision-making.

Effective financial management helps you track income and expenses, ensuring you maintain a positive cash flow. This is vital for day-to-day operations and long-term sustainability.

By mastering financial management, you can identify areas for cost reduction and revenue growth. This knowledge empowers you to make strategic decisions that drive your business forward.

Key Accounting Terms Explained

Understanding accounting terminology is essential for navigating small business finances. Here are some key terms every entrepreneur should know:

Assets: Resources owned by your business that have economic value.

Liabilities: Debts or obligations your business owes to others.

Revenue: Income generated from your business activities.

Expenses: Costs incurred in running your business.

Cash flow: The movement of money in and out of your business over a specific period.

Common Accounting Mistakes

Avoiding common accounting mistakes is crucial for maintaining accurate financial records. Here are some pitfalls to watch out for:

-

Mixing personal and business finances

-

Neglecting to track small expenses

-

Failing to reconcile accounts regularly

Proper categorization of expenses is another area where many small businesses stumble. Misclassifying costs can lead to inaccurate financial statements and tax issues.

Regular financial reviews and seeking professional advice when needed can help you steer clear of these common accounting errors.

Choosing the Right Accounting Software

Selecting the appropriate accounting software is a critical decision for small businesses. Let’s explore how to make the best choice for your needs.

Evaluating Accounting Software Options

When evaluating accounting software options, consider your business’s specific needs and growth plans. Start by assessing your current financial processes and identifying areas for improvement.

Research different software providers, comparing features, pricing, and user reviews. Look for solutions that offer scalability to accommodate your business’s future growth.

Consider factors such as ease of use, customer support, and integration capabilities with other business tools you use. A free trial period can be invaluable in determining if the software meets your requirements.

Must-Have Features for Your Business

Effective accounting software should include several key features to support your small business:

-

Invoicing and payment processing

-

Expense tracking and categorization

-

Financial reporting and analytics

-

Bank reconciliation

-

Tax preparation assistance

Look for software that offers customizable dashboards, allowing you to view your most important financial metrics at a glance. Mobile accessibility is also crucial for managing finances on the go.

Benefits of Cloud Accounting Solutions

Cloud accounting solutions offer numerous advantages for small businesses. They provide real-time access to financial data from anywhere with an internet connection.

These systems typically offer automatic backups and updates, ensuring your data is secure and your software is always up-to-date. This reduces IT maintenance costs and improves reliability.

Cloud solutions often integrate seamlessly with other business tools, streamlining your overall operations. They also facilitate collaboration, allowing you to share financial information securely with team members or advisors.

Implementing Best Accounting Tools

Implementing the right accounting tools can transform your financial management processes. Let’s explore how to make the most of these powerful resources.

Streamlining Processes with Automation

Automation is a game-changer in small business accounting. It reduces manual data entry, minimizing errors and saving valuable time.

Automated systems can handle tasks like invoice generation, expense categorization, and bank reconciliation. This frees up your time to focus on strategic business activities.

By leveraging automation, you can ensure more accurate and timely financial reporting. This leads to better decision-making and improved overall business performance.

Exploring Financial Software for Small Business

Financial software for small businesses goes beyond basic bookkeeping. Modern solutions offer comprehensive tools for managing all aspects of your finances.

These platforms often include features like inventory management, project tracking, and payroll processing. This integration provides a holistic view of your business finances.

Look for software that offers customizable reports and data visualization tools. These features can help you gain deeper insights into your financial performance and trends.

Case Studies of Successful Implementations

“Implementing cloud-based accounting software transformed our business. We reduced bookkeeping time by 70% and gained real-time insights into our finances.” – Sarah Johnson, Small Business Owner

Key takeaways from successful implementations:

-

Improved accuracy in financial reporting

-

Significant time savings on routine tasks

-

Better cash flow management

-

Enhanced decision-making capabilities

Maximizing Efficiency with Automated Bookkeeping

Automated bookkeeping can dramatically improve your financial management efficiency. Let’s explore how to make the transition and optimize your processes.

Transitioning to Automated Systems

Transitioning to automated bookkeeping requires careful planning and execution. Start by mapping out your current financial processes and identifying areas for automation.

Choose a system that aligns with your business needs and offers a user-friendly interface. Invest time in proper setup and configuration to ensure accurate data migration.

Provide thorough training for your team to ensure smooth adoption. Remember, the transition may take time, but the long-term benefits are well worth the initial effort.

Integrating Software into Daily Operations

Successful integration of automated bookkeeping into daily operations requires a shift in mindset and processes. Encourage your team to embrace the new system and its capabilities.

Set up automated data feeds from your bank and credit card accounts to ensure real-time financial updates. Regularly review and categorize transactions to maintain accurate records.

Leverage the software’s reporting features to gain insights into your business performance. Use these insights to inform your decision-making and strategy.

Overcoming Challenges in Automation

While automation offers numerous benefits, it can also present challenges. Common issues include:

-

Resistance to change from team members

-

Initial setup complexities

-

Data security concerns

Address these challenges by:

-

Providing comprehensive training and support

-

Seeking expert assistance for complex setups

-

Choosing software with robust security features

Remember, the key to successful automation is ongoing monitoring and adjustment. Regularly review your processes and make refinements as needed.

Future Trends in Small Business Accounting

The landscape of small business accounting is constantly evolving. Stay ahead of the curve by understanding emerging trends and preparing for future advancements.

Emerging Cloud Accounting Solutions

Cloud accounting solutions continue to evolve, offering increasingly sophisticated features for small businesses. These platforms are becoming more intuitive and user-friendly.

Expect to see greater emphasis on real-time collaboration and data sharing. This will enable seamless communication between business owners, accountants, and financial advisors.

Future cloud solutions may offer more industry-specific features, catering to the unique needs of different business sectors.

The Role of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to revolutionize small business accounting. These technologies will enhance automation capabilities and provide deeper financial insights.

AI-powered systems will be able to predict cash flow trends, identify potential financial risks, and suggest optimization strategies. This will enable proactive financial management.

Machine Learning algorithms will improve over time, offering increasingly accurate financial forecasts and personalized recommendations for your business.

Preparing for Technological Advancements

To prepare for future technological advancements in accounting:

-

Stay informed about emerging trends and technologies

-

Regularly assess your current systems and identify areas for improvement

-

Invest in ongoing training for yourself and your team

-

Be open to adopting new tools that can enhance your financial management

Remember, embracing technological advancements can give your small business a competitive edge. Stay agile and ready to adapt to new solutions that can drive your business forward.