Navigating the intricate world of business insurance in Australia can seem daunting, yet understanding the essential insurance requirements is crucial for safeguarding your company’s future.

Whether you’re a burgeoning startup or an established enterprise, having the right small business coverage is a legal necessity and a strategic advantage.

This guide will empower you with insights into the types of business insurance available, from liability insurance to workers’ compensation insurance, ensuring you make informed decisions tailored to your unique needs.

By diving into the nuances of insurance for startups and established businesses alike, we’ll demystify the key elements that protect your assets and foster sustainable growth.

Let us guide you through the business insurance landscape in Australia, transforming complexity into clarity and equipping you with the knowledge to thrive confidently.

Understanding Business Insurance Australia

Business insurance in Australia is a critical component of risk management for companies of all sizes.

This section explores the fundamental aspects of insurance requirements, coverage essentials, and the importance of liability protection.

👉 Need Help and Advice With Your Business Insurance? Get Help Here.

Key Insurance Requirements

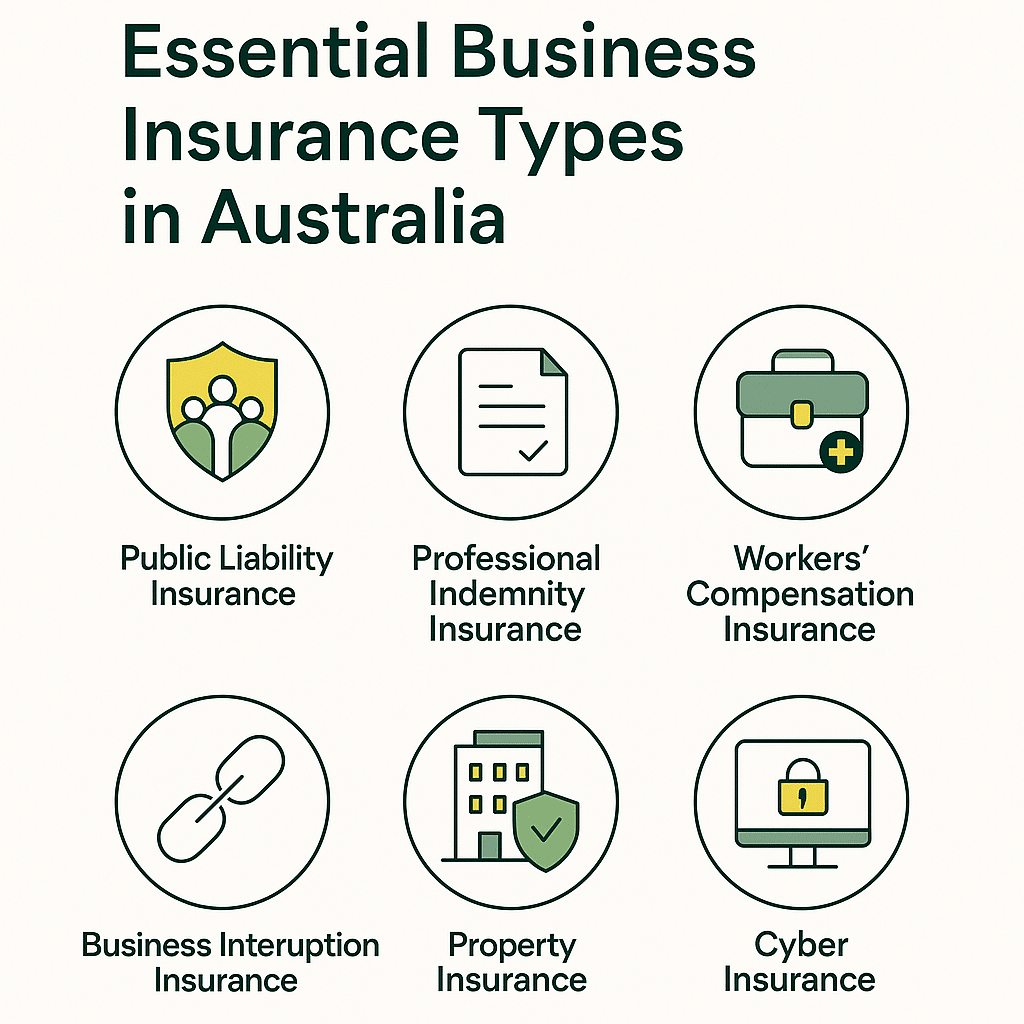

Certain types of insurance are mandatory for businesses in Australia, while others are strongly recommended.

Understanding these requirements is crucial for legal compliance and financial protection.

The Queensland Government outlines several key insurance types that businesses should consider. These include public liability insurance, professional indemnity insurance, and workers’ compensation insurance.

Additional insurance may be required for specific industries. For example, construction companies often need contract works insurance, while healthcare providers typically require medical malpractice insurance.

Consult with insurance professionals or industry associations to ensure your business meets all necessary insurance requirements.

Small Business Coverage Essentials

Small businesses in Australia face unique challenges and risks, making appropriate insurance coverage vital for their survival and growth.

A practical guide to business insurance from the Western Australian government highlights key coverage areas for small businesses. These typically include:

-

Property insurance to protect physical assets

-

Business interruption insurance to cover lost income

-

Cyber liability insurance to safeguard against digital threats

Product liability insurance is also crucial for businesses that manufacture or sell products, while professional liability insurance is essential for service-based companies.

Tailoring coverage to your specific business needs ensures comprehensive protection without unnecessary costs.

👉 Need Help and Advice With Your Business Insurance? Get Help Here.

Importance of Liability Insurance

Liability insurance is a cornerstone of business protection, shielding companies from potentially devastating financial losses due to legal claims.

Public liability insurance, in particular, is crucial for businesses that interact with the public. It covers injuries or property damage that may occur due to your business operations.

Sydney Insurance Brokers emphasizes the importance of professional indemnity insurance for businesses providing advice or services.

This coverage protects against claims of negligence or errors in professional services.

Without adequate liability insurance, businesses risk significant financial exposure that could threaten their existence. It’s not just about legal compliance; it’s about ensuring the long-term viability of your business.

Types of Business Insurance

The Australian insurance market offers various coverage options to address multiple business risks.

This section delves into comprehensive coverage options, specialized insurance for startups, and the critical area of workers’ compensation.

Comprehensive Coverage Options

Comprehensive business insurance in Australia encompasses a range of policies designed to protect against multiple risks. These options provide a safety net for businesses facing diverse challenges.

Insurance Business Magazine outlines several comprehensive coverage options, including:

-

Business Pack Insurance: A customizable bundle of coverages tailored to specific industry needs.

-

Management Liability Insurance: Protects against risks associated with managing a company.

-

Cyber Insurance: Covers losses related to data breaches and cyber attacks.

Additionally, business interruption insurance is crucial for maintaining financial stability during unexpected disruptions.

When selecting comprehensive coverage, assessing your business’s unique risk profile and choosing policies that offer the most relevant protection is essential.

Insurance for Startups

Startups face unique risks and challenges, requiring specialized insurance solutions to protect their innovative ventures.

Key insurance considerations for startups include:

-

Intellectual Property Insurance: Protects against infringement claims.

-

Directors and Officers Insurance: Covers the liabilities of company executives.

-

Errors and Omissions Insurance: Essential for tech startups offering services or products.

Startups should also consider scalable insurance options that can grow with their business. This flexibility ensures adequate coverage throughout various stages of development.

“For startups, the right insurance can be the difference between weathering a storm and closing shop. It’s not just about protection; it’s about creating a foundation for growth.” – Industry Expert.

👉 Need Help and Advice With Your Business Insurance? Get Help Here.

Workers’ Compensation Insurance

Workers’ compensation insurance is a mandatory requirement for most businesses in Australia, providing crucial protection for both employers and employees.

This insurance covers:

-

Medical expenses for work-related injuries or illnesses

-

Lost wages for employees unable to work due to injuries

-

Legal costs if an employee sues for a workplace injury

Each state and territory in Australia has its workers’ compensation scheme, with specific requirements and regulations.

Employers must ensure they comply with local laws regarding workers’ compensation coverage. Failure to do so can result in significant penalties and legal liabilities.

Navigating Insurance Policies

Understanding and selecting the right insurance policies is crucial for effective business protection.

This section guides you through comparing providers, tailoring coverage, and avoiding common pitfalls in the insurance selection process.

Comparing Insurance Providers

When selecting an insurance provider, conducting thorough research and comparisons is essential to find the best fit for your business needs.

Key factors to consider include:

-

Financial stability of the insurer

-

Range of coverage options offered

-

Customer service reputation

-

Claims processing efficiency

-

Pricing and value for money

Utilize online comparison tools and consult with insurance brokers to comprehensively view available options.

Remember, the cheapest option isn’t always the best; focus on finding the right balance between cost and coverage.

Consider seeking recommendations from industry peers or professional associations for insights into insurers with experience in your specific sector.

Tailoring Coverage to Your Needs

Customizing your insurance coverage ensures that your business is adequately protected without paying for unnecessary extras.

Start by conducting a thorough risk assessment of your business operations. Identify key areas of vulnerability and prioritize coverage accordingly.

Consider factors such as:

-

Industry-specific risks

-

Business size and growth projections

-

Geographic location and associated hazards

-

Value of assets and potential liabilities

Work closely with insurance professionals to develop a tailored package that addresses your unique needs.

This may involve combining various policy types or opting for specialized coverage in certain areas.

Regularly review and adjust your coverage as your business evolves to maintain optimal protection.

Avoiding Common Pitfalls

Navigating the complex world of business insurance can be challenging, but awareness of common pitfalls can help you make informed decisions.

Some frequent mistakes to avoid include:

-

Underinsuring: Failing to secure adequate coverage limits.

-

Overlooking critical coverage areas: Missing essential policies for your industry.

-

Misunderstanding policy terms: Not fully grasping the extent of your coverage.

-

Neglecting to update policies: Failing to adjust coverage as your business grows or changes.

To mitigate these risks:

-

Regularly review your policies with a professional

-

Stay informed about industry-specific insurance developments

-

Be transparent with your insurer about your business operations

-

Document all communications and decisions regarding your insurance

By staying vigilant and proactive, you can ensure your business remains well-protected against potential risks.

Maximizing Business Protection

Adequate business protection goes beyond just having insurance policies in place.

This section explores strategies for comprehensive risk management, future-proofing your business, and leveraging insurance benefits to their fullest potential.

Risk Management Strategies

Implementing robust risk management strategies is crucial for minimizing potential threats to your business and optimizing your insurance coverage.

Key components of an effective risk management plan include:

-

Identifying potential risks specific to your industry and business model

-

Assessing the likelihood and potential impact of each risk

-

Developing mitigation strategies to reduce or eliminate risks

-

Implementing safety protocols and employee training programs

-

Regularly reviewing and updating your risk management approach

By proactively addressing potential risks, you can reduce the likelihood of insurance claims and potentially negotiate better insurance terms and premiums.

Consider engaging risk management consultants or utilizing industry-specific risk assessment tools to enhance your strategies.

Future-Proofing Your Business

In today’s rapidly changing business landscape, future-proofing your company is essential for long-term success and stability.

Key aspects of future-proofing include:

-

Staying informed about emerging industry trends and potential disruptors

-

Investing in technology and digital transformation

-

Diversifying your business offerings and revenue streams

-

Building a flexible and adaptable organizational structure

From an insurance perspective, consider policies that offer protection against emerging risks such as cyber threats, climate-related events, or supply chain disruptions.

Regularly review and update your insurance coverage to ensure it aligns with your evolving business model and risk profile.

Leveraging Insurance Benefits

Maximizing the value of your insurance policies involves more than having coverage in place. It’s about actively leveraging your insurer’s benefits and services.

Many insurance providers offer additional services such as:

-

Risk assessment and management consulting

-

Employee safety training programs

-

Cybersecurity audits and support

-

Legal and compliance guidance

Take advantage of these value-added services to enhance your overall risk management strategy and potentially reduce your insurance costs over time.

Additionally, maintain open communication with your insurer or broker about your business goals and challenges. This can lead to more tailored coverage recommendations and potentially unlock additional benefits or discounts.

Engaging with Insurance Services

Building a strong relationship with your insurance provider ensures optimal coverage and support.

This section focuses on establishing trusted partnerships, conducting proactive policy reviews, and continuously improving your insurance coverage.

Building Trusted Partnerships

Developing a strong, trust-based relationship with your insurance provider or broker can significantly enhance the quality and effectiveness of your business insurance coverage.

Key steps in building this partnership include:

-

Open and honest communication about your business operations and risks

-

Regular meetings to discuss changes in your business or industry

-

Seeking advice and expertise on risk management strategies

-

Providing feedback on the services and support received

A trusted insurance partner should act as an advisor, offering insights and recommendations tailored to your specific business needs.

Remember, the goal is to create a long-term relationship that evolves with your business, ensuring you always have the most appropriate and adequate insurance coverage.

Proactive Policy Reviews

Regular and proactive reviews of your insurance policies are essential for maintaining optimal coverage and identifying potential gaps or redundancies.

Conduct policy reviews:

-

Annually, at ma inimum

-

When significant changes occur in your business

-

In response to primary industry or regulatory shifts

During these reviews, consider:

-

Changes in your business operations or scale

-

New or evolving risks in your industry

-

Updates to legal or regulatory requirements

-

Opportunities for consolidating or streamlining coverage

Engaging your insurance provider or broker in these reviews can provide valuable insights and ensure your coverage remains aligned with your current needs and future goals.

Continuous Coverage Improvement

The landscape of business risks is constantly evolving, making continuous improvement of your insurance coverage necessary for long-term protection.

Strategies for ongoing coverage enhancement include:

-

Staying informed about new insurance products and coverage options

-

Analyzing claims history to identify areas for improved risk management

-

Exploring emerging risks and corresponding insurance solutions

-

Seeking feedback from employees and stakeholders on potential coverage gaps

Consider implementing a structured approach to coverage improvement, such as:

-

Setting annual goals for insurance optimization

-

Conducting regular risk assessments and gap analyses

-

Benchmarking your coverage against industry standards

-

Investing in employee education on insurance and risk management

By adopting a continuous improvement mindset, you can ensure your business remains well-protected against current and future risks.