Navigating the financial landscape can be a daunting task for small business owners in Australia, especially when it comes to securing funding. Unsecured small business loans present an attractive option for entrepreneurs seeking to grow their ventures without the burden of collateral.

With a myriad of Australian business loans available, understanding the nuances of small business funding can empower owners to make informed decisions.

This guide aims to demystify the world of business finance options, offering insights into loan eligibility criteria, interest rates, and alternative funding sources.

Join us as we explore the possibilities of financing your business aspirations with confidence and clarity.

Understanding Unsecured Small Business Loans

Unsecured small business loans are a crucial financing option for Australian entrepreneurs. This section explores the fundamentals of these loans, their benefits, and common misconceptions.

What are Unsecured Loans?

Unsecured loans are financial products that don’t require collateral from the borrower. For small business owners, this means accessing funds without putting personal or business assets at risk.

These loans are based primarily on the borrower’s creditworthiness and the business’s financial health. Lenders assess factors such as credit score, cash flow, and business performance to determine eligibility.

Unsecured loans typically offer faster approval processes and more flexible terms compared to traditional secured loans. However, they often come with higher interest rates to offset the increased risk for lenders.

Benefits for Small Business Owners

Unsecured small business loans offer several advantages for Australian entrepreneurs looking to grow their ventures.

Firstly, they provide quick access to capital without the need for collateral, which is particularly beneficial for businesses with limited assets or those unwilling to risk personal property.

Secondly, the application process is often streamlined, with many lenders offering online applications and rapid approvals. This can be crucial for businesses needing to seize time-sensitive opportunities.

Lastly, unsecured loans offer greater flexibility in terms of use. Unlike some secured loans that may have restrictions on how funds can be utilized, unsecured loans generally allow business owners to allocate the money as they see fit.

Common Misconceptions

There are several misconceptions surrounding unsecured small business loans that can deter potential borrowers.

One common myth is that unsecured loans are only available to businesses with perfect credit. In reality, many lenders consider multiple factors beyond credit scores, including business revenue and growth potential.

Another misconception is that unsecured loans always have exorbitant interest rates. While rates are generally higher than secured loans, competitive options exist, especially for businesses with strong financials.

Lastly, some believe that unsecured loans are only for small amounts. However, many lenders offer substantial unsecured loans to qualified businesses, sometimes reaching into hundreds of thousands of dollars.

Exploring Australian Business Loan Options

The Australian business loan landscape offers diverse financing solutions. This section compares traditional and unsecured loans, highlights key features of small business funding, and examines interest rates and repayment terms.

Traditional vs. Unsecured Loans

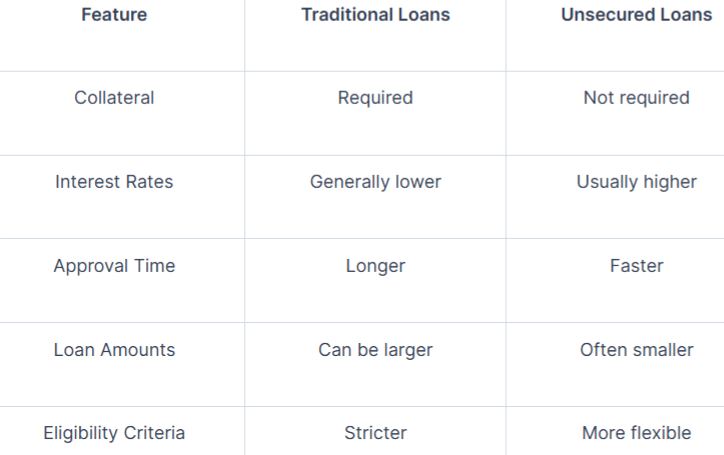

When considering business finance options in Australia, it’s crucial to understand the differences between traditional and unsecured loans.

Traditional loans typically require collateral, often in the form of business or personal assets. They generally offer lower interest rates but involve longer approval processes and stricter eligibility criteria.

Unsecured loans, on the other hand, don’t require collateral but may have higher interest rates. They usually feature faster approval times and more flexible terms, making them attractive for businesses needing quick capital.

The choice between these options depends on factors such as the business’s asset base, urgency of funding needs, and risk tolerance. A comparison table can help illustrate the key differences:

Key Features of Small Business Funding

Small business funding in Australia comes with several key features that entrepreneurs should be aware of when exploring their options.

Loan amounts can vary significantly, ranging from a few thousand dollars to several million, depending on the lender and the business’s needs and qualifications.

Repayment terms are another crucial feature, with options ranging from short-term loans of a few months to long-term financing extending over several years.

Interest rates and fees are important considerations. These can include establishment fees, ongoing service fees, and early repayment fees. It’s essential to understand the total cost of borrowing, not just the headline interest rate.

Flexibility in use of funds is another key feature, with some loans allowing for general business purposes while others may be restricted to specific uses like equipment purchase or working capital.

Interest Rates and Repayment Terms

Interest rates and repayment terms for unsecured small business loans in Australia can vary widely based on several factors.

Interest rates typically range from 5% to 30% per annum, depending on the lender, loan amount, and the business’s risk profile. It’s important to note that some lenders may quote rates as a factor rate rather than an annual percentage rate (APR), so careful comparison is crucial.

Repayment terms can be equally diverse. Short-term loans might require daily or weekly repayments over a few months, while longer-term loans could involve monthly repayments over several years.

Many lenders offer flexible repayment options, such as the ability to make extra repayments without penalty or to adjust payment schedules based on business cash flow. However, it’s essential to read the fine print, as some loans may have early repayment fees or other restrictions.

Navigating Loan Eligibility Criteria

Understanding loan eligibility criteria is crucial for Australian small business owners seeking unsecured funding. This section outlines essential requirements, factors influencing loan decisions, and tips for improving eligibility.

Essential Requirements for Approval

Securing an unsecured small business loan in Australia typically involves meeting several key requirements.

Most lenders require businesses to have been operating for a minimum period, often at least six months to a year. This demonstrates a track record of business operations and financial management.

A minimum annual revenue threshold is common, with many lenders looking for businesses generating at least $50,000 to $100,000 per year. This helps ensure the business has sufficient cash flow to service the loan.

Credit history is another crucial factor. While perfect credit isn’t always necessary, a reasonable credit score (typically above 500) is often required. Some lenders may also consider the business owner’s personal credit history.

Factors Influencing Loan Decisions

Lenders consider various factors when evaluating unsecured small business loan applications in Australia.

Business performance is a key consideration. Lenders will examine financial statements, including profit and loss statements and balance sheets, to assess the business’s financial health and growth trajectory.

Industry sector can also play a role. Some lenders may have preferences or restrictions based on industry risk profiles or their own expertise in certain sectors.

Purpose of the loan is another important factor. Lenders want to understand how the funds will be used and how this aligns with the business’s growth plans and ability to repay.

Business credit score, separate from the owner’s personal credit, is increasingly important. This score reflects the business’s credit history and financial responsibility.

Tips for Improving Eligibility

Improving loan eligibility can significantly increase a business’s chances of securing favorable unsecured financing. Here are some key strategies:

-

Maintain accurate and up-to-date financial records. This demonstrates financial responsibility and makes it easier for lenders to assess your business.

-

Build a strong credit history for your business. Pay bills on time and manage any existing credit responsibly.

-

Develop a solid business plan. This shows lenders that you have a clear vision for your business and understand your financial needs and projections.

-

Consider improving your personal credit score. While not always required, a strong personal credit history can bolster your application.

-

Be prepared to explain any past financial difficulties and demonstrate how you’ve overcome them.

Alternative Funding Sources for Businesses

While unsecured loans are a popular choice, Australian businesses have access to various alternative funding sources. This section explores government grants, venture capital, and innovative financing methods like crowdfunding.

Government Grants and Programs

The Australian government offers numerous grants and programs to support small businesses, providing valuable alternatives to traditional loans.

These initiatives often target specific industries, regions, or business objectives. For example, the Entrepreneurs’ Programme offers business management advice and grants for commercialization and innovation.

To access these opportunities:

-

Research available grants on the business.gov.au website.

-

Check eligibility criteria carefully.

-

Prepare a strong application, highlighting how your business aligns with the grant’s objectives.

-

Consider seeking professional assistance for complex applications.

While grants can provide non-repayable funds, they often require detailed reporting and adherence to specific conditions.

Venture Capital and Angel Investors

For high-growth potential businesses, venture capital (VC) and angel investors can be attractive funding sources.

Venture capital firms typically invest larger amounts in exchange for equity, often providing valuable expertise and industry connections alongside capital. Angel investors, usually wealthy individuals, tend to invest smaller amounts in early-stage companies.

Key considerations for attracting VC or angel investment include:

-

A scalable business model with high growth potential

-

A strong, experienced management team

-

A clear exit strategy for investors

-

Thorough market research and financial projections

While these sources can provide substantial funding, they also involve giving up a portion of ownership and control in your business.

Crowdfunding and Peer-to-Peer Lending

Innovative financing methods like crowdfunding and peer-to-peer (P2P) lending have gained popularity in Australia, offering alternative ways to raise capital.

Crowdfunding platforms allow businesses to raise small amounts from a large number of individuals. This can be particularly effective for businesses with a compelling story or innovative product. Types of crowdfunding include:

-

Reward-based (backers receive products or perks)

-

Equity-based (backers receive shares in the company)

-

Donation-based (for non-profit or social enterprises)

Peer-to-peer lending platforms connect businesses directly with individual lenders, often offering competitive rates and flexible terms. These platforms typically use technology to assess risk and match borrowers with lenders.

While these methods can provide access to capital, they require careful planning and often significant marketing efforts to succeed.

Making Informed Business Finance Decisions

Choosing the right financing option is crucial for business success. This section guides you through evaluating your needs, comparing options, and learning from successful case studies.

Evaluating Your Business Needs

Before seeking any form of business finance, it’s essential to thoroughly assess your business needs and financial situation.

Start by clearly defining the purpose of the funding. Are you looking to expand operations, purchase equipment, or manage cash flow? Understanding the specific need will help you choose the most appropriate financing option.

Next, evaluate your business’s current financial health. This includes analyzing cash flow, profitability, and existing debt obligations. Consider creating financial projections to understand how different loan amounts and terms might impact your business.

Finally, assess your risk tolerance. Are you comfortable with the potential consequences of taking on debt, or would you prefer to explore equity-based options? This self-assessment will guide you towards the most suitable financing solutions for your business.

Comparing Business Finance Options

When comparing business finance options, it’s important to look beyond just the interest rate. Consider the following factors:

-

Total cost of borrowing: Include all fees and charges over the life of the loan.

-

Repayment flexibility: Can you make extra repayments or adjust the payment schedule?

-

Loan term: How does this align with your business needs and cash flow?

-

Speed of funding: How quickly can you access the funds?

-

Eligibility criteria: Can you meet all the requirements?

Create a comparison table to help visualize the differences:

|

Factor |

Unsecured Loan |

Secured Loan |

Government Grant |

Venture Capital |

|---|---|---|---|---|

|

Cost |

Higher interest |

Lower interest |

No repayment |

Equity dilution |

|

Speed |

Fast |

Slower |

Very slow |

Variable |

|

Amount |

Limited |

Higher |

Limited |

Potentially high |

|

Control |

Maintained |

Maintained |

Maintained |

Shared |

Case Studies: Successful Loan Utilization

Examining real-world examples can provide valuable insights into effective use of business finance. Here are two brief case studies:

Case Study 1: Tech Startup Expansion

A Melbourne-based software company secured a $200,000 unsecured loan to fund international expansion.

Key takeaways:

-

Used the loan to hire international sales staff and localize their product

-

Achieved 150% revenue growth within 18 months

-

Repaid the loan early, saving on interest

Case Study 2: Retail Inventory Management

A Sydney retailer obtained a $50,000 unsecured loan to optimize inventory management during peak seasons.

Results:

-

Invested in inventory management software and increased stock levels

-

Reduced stockouts by 60% and increased sales by 35%

-

Improved cash flow allowed for early loan repayment

These cases highlight the importance of:

-

Clear purpose for the funds

-

Strategic application of financing

-

Focus on revenue growth and efficiency improvements

-

Proactive loan management and early repayment when possible